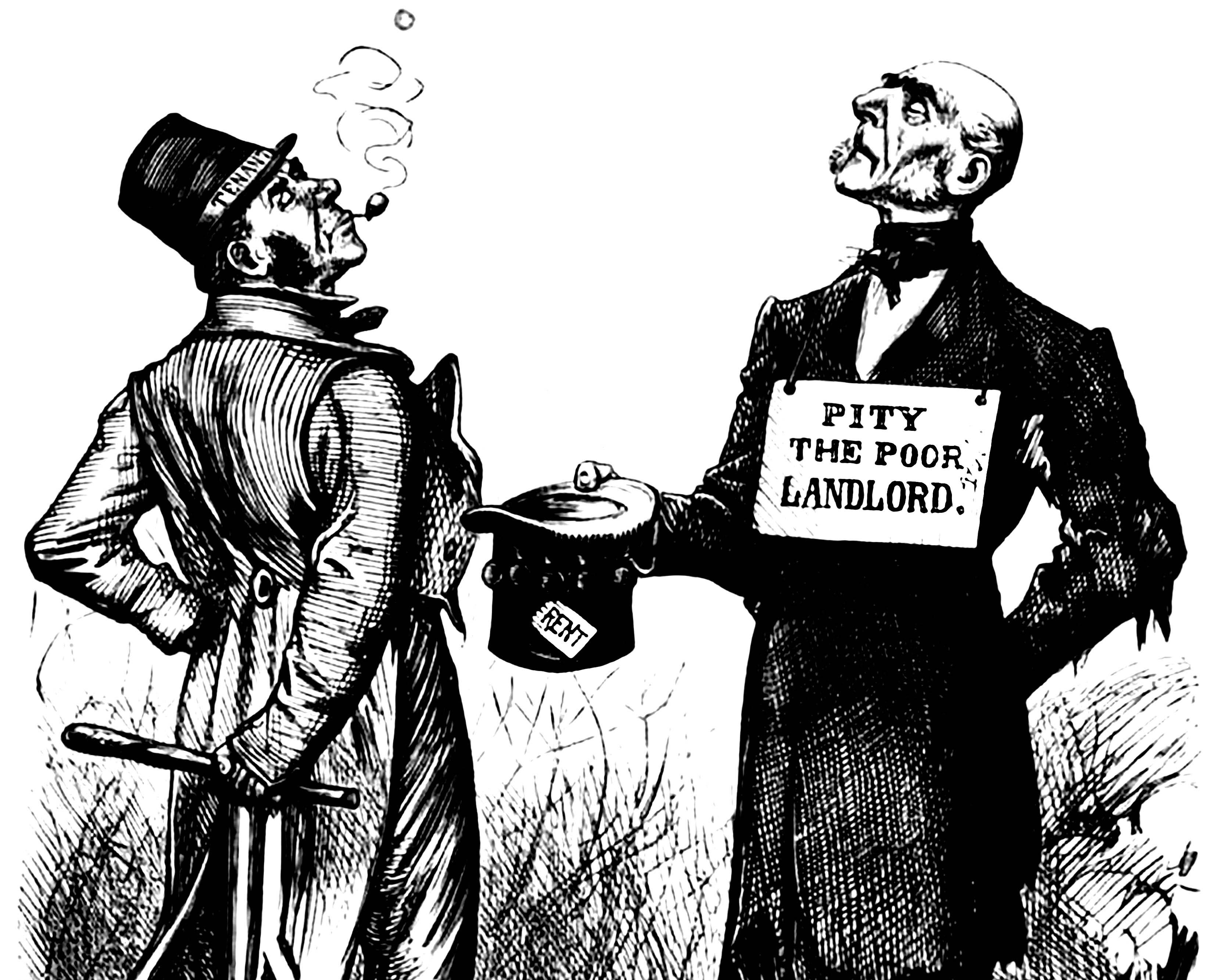

Rents are on the up!

(Landlords on top...)

It's good news at last for landlords. After a difficult decade - falling rents, stagnating property prices and the loss of mortgage relief among the many obstacles - it's turnaround time. For the first time in more than 10 years, rents are on the rise again.

Average weekly rents rose by 14% in the year leading up to April 2022. With Just 65% of the usual number of properties available at this time of year, properties are letting four times faster than usual, often receiving multiple offers within 24-48 hours of going online. In short, it's a good time to be a London landlord again, as many of our clients are discovering. "We're getting multiple offers and bidding wars as soon as our properties are available," comments Mr Salem, a Fulham landlord who not only lost income through longer void periods on his flats during lockdown but also from having to close the chain of restaurants he runs. Now, he reports a 28% increase in rent for his properties since the start of the pandemic. Iulia Tuliani, who manages a large Fulham portfolio, describes the market as "booming, very active and achieving the highest prices ever". Their one-bed flats have seen a 36% increase in rent post-Covid now fetching £1,711 per month, and rent for their two0beds has risen by 47% to £2,210 a month. Greatest of all, however, is landlord Elizabeth Henderson's change in fortunes since Covid. Her Sloane Square property is achieving 96% more now than at the height of the pandemic. "We are super happy with the bounceback. It's helping to cover the Covid loss." Henderson comments.

No doubt for many landlords, the bounceback feels like a long time coming. Ever since the Global Financial Crisis in 2008, equity began pouring into London's buy-to-let market, which was perceived as a far safer haven than the financial services market. Professional investors were drawn by low interest rates. High net worth overseas investors like the UK's relative political stability and its favorable tax and legal system. Combine all that with many new landlords entering the market, attracted by cheap debt, low interest rates and rising asset prices. In this balmy climate, few buy-to-let landlords ever wanted to sell - so, gradually, the bounteous supply of rental properties began dragging down London rents down by an average of 10% over 10 years. That was a slow drip, through. What happened with lockdown in 2020 felt like someone had turned off the tap altogether. Rental searches fell by up to 73% in West London as younger tenants moved back home, while others sought more spacious homes and gardens outside of the capital. A survey by the NRLA found that 56% of landlords properties in Central London saw tenant demand fall in the first quarter of 2021 compared to the same period in 2022. With tenants unable to view properties, new tenancies ground to a halt. So did renewals, which fell by 80% according to our figures. Subsequently prices crashed. Alongside nose-diving rents was the reality of falling property values in central London, Triggered by the uncertainty of the Brexit referendum and the ensuing few years of political wrangling.

Financially, and mentally, landlords are usually able to off-set the mounting costs and obligations they face with the promise of long-term capital growth and a big payday further down the line. But in recent years that hasn’t looked so certain – or at least, that payday has seemed far more distant than they had accounted for. With higher tax bills, added fees and no longer being able to offset their borrowing costs, many landlords couldn’t find the necessary cashflow to prop up their buy-to-let and sold up. “It was a difficult period to navigate,” says Tuliani of the pandemic. “Our prices dropped by 20% and void periods increased as many tenants left.”

Some made a quick leap from lucrative short lets to long lets. “It wasn’t my preference, but the uncertainty was the hardest thing for me being overseas during the pandemic,” says Theresa Oswald, who owns rental properties in Chelsea. The experience has taught her to appreciate “consistency” over high returns, she says. “There is a balance to be met between pushing for top rent and appreciating a good tenant who will stay for longer.”

Beyond the financial hit, landlords were also navigating a sense of social obligation that they perhaps hadn’t felt before. Tuliani describes the “vulnerability” of her tenants during lockdown, when many young renters were stuck alone, and working from home, in small properties with no outdoor space. “We were worried for their needs and their wellbeing,” Tuliani comments, while Salem describes the frustration of failing to find contractors during lockdown to carry out repairs. “This meant we had tenants unhappy that problems weren’t being fixed quickly enough.

Henderson negotiated with her tenant, who wanted a near 50% discount. “We wanted to do the right thing during the crisis. We learnt that 60% of something is better than 100% of nothing.”

Landlords who held their nerve, though, are now reaping the rewards. Rising rental prices mean the buy-to-let model is looking sustainable again. And the exodus of landlords from the market during the hard times means the limited number of available properties is further pushing up prices.

And we believe this will continue to be the case. As we enter the Spring and Summer markets, we don’t expect stock levels to recover significantly. But neither do we expect to see landlords’ costs come down. They may even rise further if the Government fails to do more, such as introduce positive tax changes, to support private landlords. With interest rates likely to rise this year, fewer new landlords will enter the market, more will leave, and rental prices will continue their upward trajectory.

Henderson is among the fortunate ones to have a debt-free investment property. “If we’d had a mortgage, we would have been extra stressed,” she says of the last two years. “The hardest part was having to swallow the loss in rent, but on the plus side our property wasn’t empty and we didn’t have to pay the bills, like many of our landlord friends.”

Others are reflecting on what being a landlord during the pandemic has taught them too. “We can only control so much. We learnt the need to support tenants more with reductions has meant they have stayed longer afterwards,” says Tuliani. Salem rues not having “locked tenancies in for longer when we were achieving high rental prices. Then it limits void periods and risk of fluctuation in the rent.”

What the Covid years have taught landlords is to balance risk with reward. A good long-term tenant at a good price is worth far more than aggressively pushing up the rent and finding a tenant who then leaves – and leaves you with a void.

Rent increases should happen naturally and in line with the market, when a property comes up for renewal or re-letting. But the fact remains the rents ARE rising. And that, for landlords after a tricky two years, is something to celebrate.